owe state taxes california

On January 1st 2022 250 shares 14 of your RSUs will vest at a stock price of 10. How California taxes residents nonresidents and part-year residents.

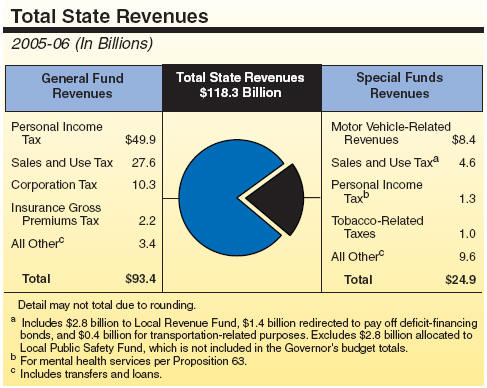

California S Tax System A Primer

California is one of 43 states that collects state income taxes and currently has the highest state income tax rate in the US.

. Ad Want Zero Balance Fresh Start. Ad Owe back tax 10K-200K. Possibly Settle For Less.

100 of the amount due. In California the lowest tax bracket is. The personal income tax rates in California range from 1 to a high of 123 percent.

See if you Qualify for IRS Fresh Start Request Online. California for instance has the highest state income tax rate in the United States. This can pay anywhere from 255 to 6728.

Ad Help With Unpaid Taxes Unfiled Taxes Penalties Liens Levies Much More. On June 2 2019 the FMV is 2 and you exercised the 2500 NSOs that vest. The usual reason is that you did not have enough tax withheld from your paychecks and still owe the state more.

Federal tax brackets go from 10 for incomes between 10000 and 19999 to 37 for those earning more than 523600. Its tax sits at 133. Your NSOs have a 4-year vesting schedule with a 12-month cliff and shares vest annually thereafter.

Paying taxes owed to the state of California can be completed either online in person by mail or by. Get Tax Relief That You Deserve With ECG Tax Pros. The maximum penalty is 25.

Important State gas price and other relief proposals. Release State Tax Levy Fast. Whichever amount is less.

The state of California will require you to pay tax on the profit. For the latest tax year your California corporation had taxable net income of 100000. It comes in fourth for combined income and sales tax.

How California taxes residents nonresidents and part-year residents. California residents - Taxed on ALL. You lived in California through June 30th and moved to Washington on July 1st.

There are 43 states that collect state income taxes. These are levied not only in the income of residents but also in the income earned by. Tax Help Has Arrived.

The Different Types of. What happens if you owe California state taxes. If your tax return shows a balance due of 540 or less the penalty is either.

Other things being equal your corporation will owe California. For instance low-income families may qualify for the Earned Income Tax Credit EITC federally and the California EITC on their state tax return. Ad Owe back tax 10K-200K.

Some businesses in the state of California have the option to be taxed by a Franchise Development Corporation This corporation provides the business with tax advice prepares and. Up to 25 cash back Example. Cant Pay Unpaid Taxes.

Double check all of the amounts you entered from yourW-2s. See if you Qualify for IRS Fresh Start Request Online. FTB is aware of multiple proposals from the Governor and Legislature to help Californians cope with rising prices of gas and other.

Penalty and Interest There is a 10 penalty for not filing your return andor paying your full tax or fee payment on time.

Why Does California Have Some Of The Highest State Income Tax And State Sales Tax In The Country Quora

You Owe Taxes In California What Happens Landmark Tax Group

Understanding California S Sales Tax

2021 Personal Income Tax Booklet California Forms Instructions 540 Ftb Ca Gov

California Tax Forms H R Block

California Llc Annual Llc Franchise Tax Youtube

What Are California S Income Tax Brackets Rjs Law Tax Attorney

California Ftb Rjs Law Tax Attorney San Diego

I Owe California Ca State Taxes And Can T Pay What Do I Do

California Use Tax Information

Irs Form 540 California Resident Income Tax Return

Understanding California S Sales Tax

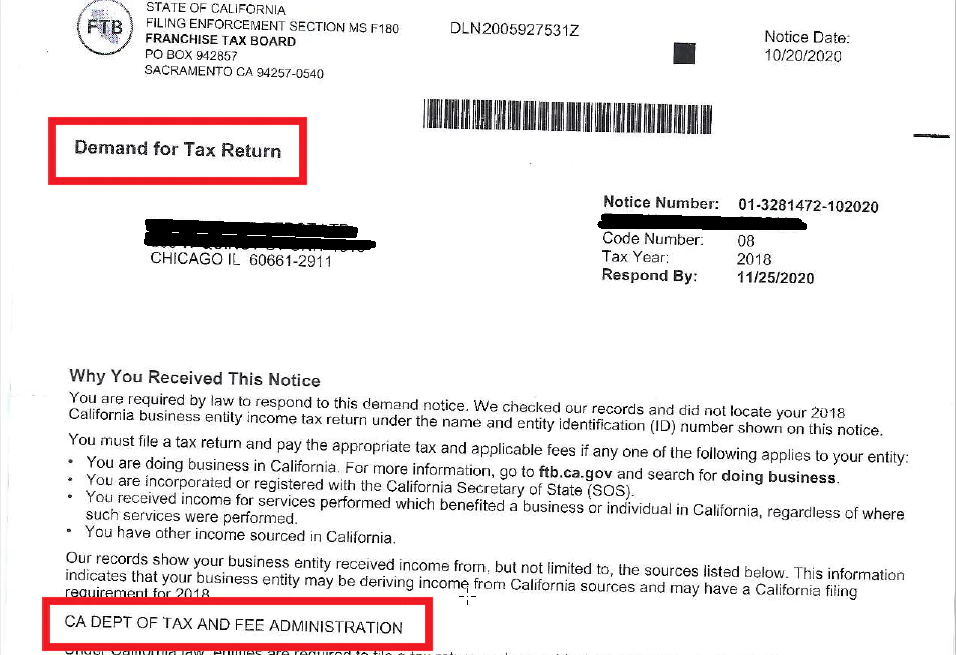

Handling A Ca Franchise Tax Board Ftb Demand Letter For Out Of State Online Sellers Capforge

California S Tax System A Primer

Where S My State Refund Track Your Refund In Every State Taxact Blog

Scv News Lookup Table To Help When Filling Out California Income Tax Return Scvnews Com

California Wealth And Exit Tax Would Be An Unconstitutional Disaster Foundation National Taxpayers Union